Hopeful Louisville Governor to Crack Down on Payday Loans

Louisville businessman Bruce Lunsford, one of seven Democrats running for governor, said yesterday that he would press the legislature to crack down on the pay day loan and subprime mortgage industries if elected.

He said too many low-income people find themselves getting deeper in debt or risk losing their homes because of loans that carry very high interest rates or fees.

“Government hasn’t protected these people,” Lunsford said in a conference call with reporters.

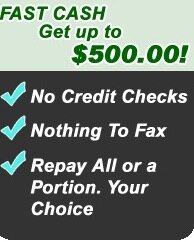

John Rabenold, a spokesman for the Kentucky Deferred Deposit Association, said the no fax payday advance business already is regulated. He also said he isn’t aware of abuses in the industry, which offers short-term loans of up to $500 to people who are supposed to pay them back within 14 days.

“It’s a very convenient and confidential service customers have grown to appreciate in Kentucky,” he said.

“It’s a very convenient and confidential service customers have grown to appreciate in Kentucky,” he said.

However, the industry has attracted critics among some lawmakers and advocates who say payday and so-called “subprime,” or high-cost, mortgage loans prey on the poor and disadvantaged.

Bad credit payday loans are deceptive because many people don’t realize the true cost, said Ann Marie Reagan, a lawyer with the Kentucky Office of Legal Services, which has lobbied for tighter rules on such loans. State law allows lenders to charge up to $17.50 per $100, or $87.50 for a two-week loan of $500, she said.

That would amount to an annual interest rate of 459 percent if the loan were refinanced every two weeks over a year, Reagan said.

But Reagan said efforts to persuade lawmakers to impose additional restrictions on quick cash loans and sub-prime mortgage loans have failed in recent years amid intense industry opposition.

Lunsford said that if he’s elected, he will work to persuade lawmakers to enact tougher laws.

He said he wants to:

- Sharply reduce fees on payday loans and ban penalties for early payment

- Ban loan “flipping,” in which borrowers repeatedly refinance payday cash advances at high rates

- Ban excessive fees and penalties for paying off a mortgage early

- Prohibit mandatory arbitration, required in some loan contracts, which blocks people from filing lawsuits

Lunsford said a number of people raised concerns about the issue at a series of barbecue town meetings he and his running mate, Attorney General Greg Stumbo, have held around Kentucky.

He said it has nothing to do with the fact that one of his opponents in the May 22 Democratic primary, Lexington lawyer Steve Beshear, worked as the payday loan industry’s top lobbyist for several years in the late 1990s.

“I’ve done everything I can in this campaign not to address anyone else’s activities,” Lunsford said.