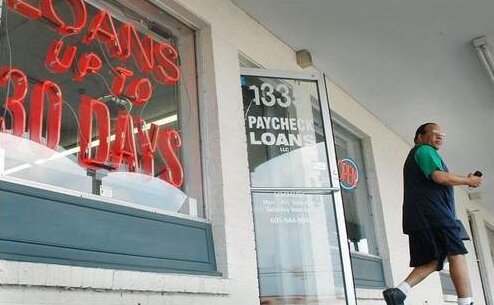

Group Offers Alternatives to Delaware Payday Loans

Seeking to break “the endless cycle of debt and despair” caused by high-cost payday advance lending, a Wilmington nonprofit organization Monday launched an alternative program with low interest rates and longer terms.

West End Neighborhood House’s Worker’s Loan Program will provide short-term loans with 13.49 percent annual interest rates to compete with commercial lenders that charge rates equal to 300 percent or more annually, said Michael Fleming, a member of West End’s board of directors.

West End Neighborhood House’s Worker’s Loan Program will provide short-term loans with 13.49 percent annual interest rates to compete with commercial lenders that charge rates equal to 300 percent or more annually, said Michael Fleming, a member of West End’s board of directors.

He and several political and community leaders gathered Monday at West End to formally kick off the program.

Borrowers will also get financial counseling and be able to pay back their quick payday loan over four pay periods, rather than the 14-day terms typically offered by commercial lenders.

The program is the first in Delaware to offer an alternative to commercial payday lenders, but others are being developed. Later this month, American Spirit Federal Credit Union in Newark will begin providing 30-day loans at 18 percent, and the Delaware Community Reinvestment Action Council expects to partner with a credit union next year to start a short-term loan program for Wilmington residents.

Nationwide, nonprofit groups, credit unions and banks are beginning to compete with commercial lenders.

Steven Schlein, spokesman for the industry group Community Financial Services Association of America, has said commercial lenders welcome competition but alternative lenders will find it impossible to offer cheaper loans.

The number of cash advance online lenders in the United States has grown from virtually zero before 1990 to about 24,000 today, Schlein said. The largest commercial lenders see relatively thin profit margins, he said.

West End worked with several banks, financial companies and other nonprofit agencies’s program to develop the program. The F.A.I.T.H. Center, a cooperative effort among several Wilmington churches, applied for the initial grant from the nonprofit Speer Trust to start the program.