Air Academy Federal Credit Union has begun offering its members an alternative to no fax payday loans at a fraction of the interest rate such lenders charge.

The city’s second-largest credit union is charging an 18 percent annual rate for its “Smart Solution” loans, which are made without a credit check or collateral and must be repaid in 60 days, said Karin Kovalovsky, Air Academy’s vice president of marketing.

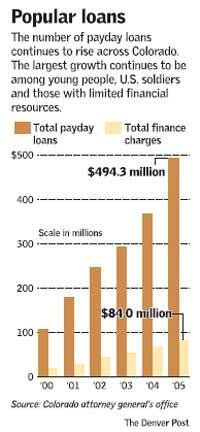

Faxless payday advance lenders in Colorado charged rates averaging 345 percent in 2005, the latest information available, and can charge rates as high as 520 percent under state law, according to a report from the Colorado Attorney General’s Office.

Payday borrowers often extend the loans and end up paying more in fees than they initially borrowed.

“We began offering this product on a limited basis to those members who don’t qualify for traditional loans,” Kovalovsky said. “We want our members to avoid going to payday lenders and getting caught in a cycle of debt that is hard to get out of.”

To get the loans, borrowers have to have been an Air Academy member for six months and earn an income after taxes of $1,000 a month, or $1,200 before taxes, Kovalovsky said. Borrowers must apply for loans at one of Air Academy’s 11 branches.

The credit union has about 44,000 members, including active-duty and retired military personnel; all employees and cadets at the Air Force Academy; employees and students in 10 area school districts and employees of 120 area companies and organizations.

Air Academy limits the amount of its Smart Solution loans to $300 for the first three loans, but the amount can be increased to $500 if the borrower pays back the loans on time, Kovalovsky said. The credit union charges a $30 application fee for each loan.

Borrowers who take out six of the instant cash loans within a year will be required to enroll in the credit union’s financial education program, Kovalovsky said.

A $300 loan under the program would cost nearly $37 in interest and fees, while a payday loan of the same amount would cost $60 at most local lenders and would have to be repaid within two or three weeks.

Air Academy has made 28 loans since starting the program two months ago on a limited basis, and none have defaulted, Kovalovsky said. More than half of the borrowers have some affiliation with the military, similar to the makeup of the credit union’s membership, she said.

Ent Federal Credit Union, the region’s largest financial institution with nearly 180,000 members, offers a $500 emergency quick payday loan, but only to employees of companies participating in the America’s Family program. Jim Moore, an Ent senior vice president, said the credit union plans to offer the loan to all members within three months.

Security Service Federal Credit Union also offers emergency loans, but only to military or their family members affected by a deployment. Armed Forces Bank and Academy Bank offer “workout” loans, limited to the borrower’s monthly pay before taxes that include no credit check.

SOURCE: The Colorado Springs Gazette

“This is a public-relations act from an industry under heavy fire,” says Jean Ann Fox, director of consumer protection for the Consumer Federation of America.

“This is a public-relations act from an industry under heavy fire,” says Jean Ann Fox, director of consumer protection for the Consumer Federation of America.