Coming to the Defense of Payday Loans

Courtesy of an AOL Money & Finance blog …

For the uninitiated, payday cash advance lending is an industry that provides short-term loans that are generally due when the borrower receives his next paycheck. For this “service,” the borrower pay an outrageous interest rate, generally 10-30 dollars per 100 dollars borrowed, a steep rate for a 14-day loan.

Advocates of increased regulation of the payday lending industry frequently point out that, annualized, the interest rates on these loans frequently runs high into the triple-digits. The Consumer Federation of America reports that the average annual interest rate on these payday loans is 470%.

Advocates of increased regulation of the payday lending industry frequently point out that, annualized, the interest rates on these loans frequently runs high into the triple-digits. The Consumer Federation of America reports that the average annual interest rate on these payday loans is 470%.

It seems that, these days, you will make very few friends as an apologist for the payday lending industry. To help battle its hugely negative image, the industry trade group, The Community Financial Services Association of America, has launched a nationwide advertising campaign, and promised to give borrowers more time to pay off loans.

Thirteen states have effectively banned payday lending, although Georgia is currently mulling allowing it again. According to the National Conference of State Legislatures, 52 no fax cash loan related bills have been introduced in state legislatures.

Critics of payday lending argue that it traps borrowers into a cycle of debt, and preys on low-income people, especially minorities. This is a legitimate complaint to be sure. In fact, it sounds a lot like another opportunity that is heavily regulated by states. and that states run: the lottery. According a study conducted at the University of Georgia, African Americans are three times as likely as whites to play the Lottery frequently. An individual without a high school diploma is four times as likely to play the Lottery as someone with a diploma.

An African American male without a high school diploma is more than 30 times more likely to play the lottery frequently than a white female with a post-secondary education.

I certainly don’t think that online payday loan lending is good for consumers, although the CFSA makes that case:

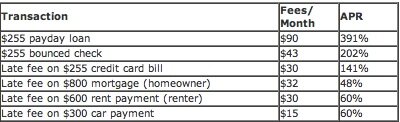

But, even if the loan was rolled over for the entire year, the high APR of payday loans pales in comparison to the realistic alternatives considered by consumers.

How does a $100 payday loan compare?

$100 payday advance with a $15 fee = 391% APR

$100 bounced check with $54 NSF/merchant fees = 1,409% APR

$100 credit card balance with a $37 late fee = 965% APR

$100 utility bill with $46 late/reconnect fees = 1,203% APR.

Why such high rates for borrowing?

Why such high rates for borrowing?