Delaware Plans Credit Union as Payday Advance, Cash Loan Alternative

Don't worry, The News Journal inn Wilmington wants to tell residents, low-income consumers will have financial alternatives by this time next year.

Community activists, led by the Delaware Community Reinvestment Action Council, are planning to launch a credit union that they say will cater to the needs of low-income people living and working in the state's largest city.

One of the main purposes will be to provide individuals with an alternative to high-interest online payday loans, said Rashmi Rangan, executive director of the Delaware Community Reinvestment Action Council, a nonprofit consumer advocacy group focused on banking.

She said the credit union, which hopes to open for business in mid-2007, will make loans with low double-digit interest to eligible members. This would run in opposition to the fees charged on most faxless payday loans in the state.

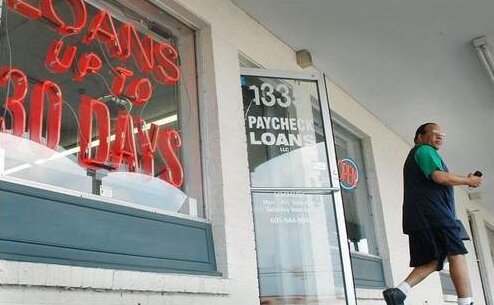

Payday advance proliferation: Payday advances are widespread in Delaware because the state imposes no cap on the interest lenders can charge. Rangan couldn't provide an estimate for how much money is lent annually across the state, but statistics from the bank commissioner's office show that there are 20 fast payday loan lending locations in the Wilmington area alone.

That's a lot.

About two dozen people are involved with organizing the credit union idea.

"We see this as a great opportunity to help people better manage their credit, and we see it as an opportunity to give people access to loans without losing the shirts off their backs," said Lance Bruce, chairman of the 3rd District Planning Council, a Wilmington community group supporting the credit union.

Credit unions, like banks, take deposits and make loans. Unlike banks, however, they are nonprofit and owned by their depositors (or members). Organizers haven't settled on a name yet. Among those under consideration are Stepping Stones Federal Community Credit Union and Wilmingtonians' Federal Community Credit Union.

Rangan said she hopes to submit the application to open the credit union to federal regulators late next month and speed up the process of lowering the popularity savings account payday loans. She and the other organizers have to get clearance from the National Credit Union Administration.

To fund the credit union's operations initially, organizers plan to apply for a grant from Catholic Charities. Rangan said she also hopes Delaware banks will make funds available for loans as a way of fulfilling their "community reinvestment" requirements under federal law.

The credit union's goal is to have 200 members, $60,000 in deposits and $200,000 in loans in its first year. Rangan said the credit union also will focus on educating members about banking, wise use of credit and how to improve their credit scores - all things that do NOT including applying for any online cash loans. She hopes members will use what they learn to move on to establish accounts at banks and larger credit unions, which would have the ability to make larger loans.

Most of the membership in the credit union - 60 percent - will be reserved for low-income Wilmington residents. But other people who live or work in Wilmington can join, Rangan said.

Derrick Lightfoot, a senior planner with the city of Wilmington, said he's interested in joining to support the credit union's mission."This has promise," Lightfoot said. "Anything we can do to lessen the grip of payday loans on people, we need to do that."