Former Cash Advance Lender Leads Fight in Colorado Against Payday Loan Industry

By Paul RizzoPayday Loan Writer

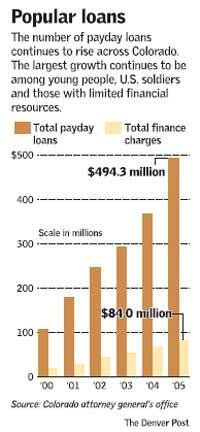

Young people, U.S. soldiers and others with limited financial savvy most often fall prey to the short-term lenders, said Terri Verrette, a former payday advance lender.

She is now a financial counselor at America’s Family, a Colorado Springs nonprofit group that helps poor people become more self-sufficient. As reported by The Denver Post, Verrette characterizes such lending as predatory because many borrowers end up thousands of dollars in debt after taking out relatively small loans.

“The most fascinating thing you see is someone who doesn’t realize how much interest he’s paying,” she said.

Payday loans: A military problem - U.S. military personnel at Fort Carson acknowledged the problem. A U.S. soldier found to be using no faxing payday loan lenders can have his or her security clearance revoked and be released from active duty, said Patricia Randle, financial-readiness program manager at Fort Carson.

“They don’t want anyone in their command to know, so they feel it’s a quick way to get cash,” Randle said.

U.S. Sen. Wayne Allard recently added a rider to a defense bill to limit loan rates charged to soldiers. The bill has been passed by Congress and is awaiting approval from the president.

“Predatory lending is an abhorrent practice but especially when it takes advantage of our men and women in uniform,” Allard said.

America’s Family wants credit unions and others to offer similar revolving lines of credit of not more than $500, with cheaper fees and low interest rates than payday cash advances, said Steve Bigari, the group’s founder.

Bigari is working with Ent Credit Union in Colorado Springs to offer such a product to customers who need quick cash.

The nonprofit, backed by Colorado philanthropists such as Bigari, Bill Daniels and Phil Anschutz, may guarantee such personal loans, for example, Bigari said. Ent traditionally has catered to military personnel.

Credit unions typically don’t take on such loans because the risk of nonpayment is so high, said James Moore, senior vice president of Ent Credit Union. But he is considering Bigari’s proposal.

“We still do have a commitment to serving the underserved,” Moore said. “We continue to look for ways to provide services to those people.”

Payday loan example: Joshua Maestes, 21, is a typical cash loan borrower.

About a year ago, he needed about $200 to cover part of the rental deposit on a new apartment. He borrowed the money from Check Into Cash, a national payday loan chain store near Fort Carson. Before he knew it, the interest rate of his first two-week loan had escalated to 120 percent, and he was on a payback schedule that had him paying more and more every week.

“They’re a little misleading. They always ask if you want to roll (the loan) over or get more money,” Maestes said.

He accepted, using the extra cash to eat out and on various consumer items.

The local Check Into Cash store referred payday loan online questions to a national office, which declined to comment.

Payday loan stores serve a niche market, said Lowell Chatburn, a manager of four Paycheck Loan stores in Colorado, including one in Boulder.

“A lot of people come in here because they’re forced to by the fees the banks charge,” Chatburn said.

Maestes has made all but one payment on his payday loan, after receiving a promotion at his computer job. He said he now realizes how much the cash advance really cost him and plans to borrow in the future from his bank, which “charges a lot less.”

“I got into a situation where I had to keep coming back each week. It was really frustrating,” Maestes said.