Former Payday Advance Employee Charged with Check/Payday Loan Forgery

By J.J. CameronPayday Loan Writer

Thinking about applying for a payday loan? Make sure you can trust your source. Case in point:

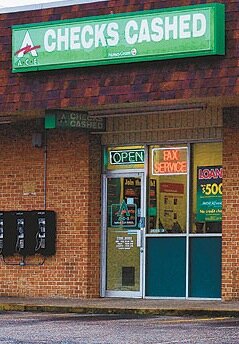

Vickie Frasure, 46, of Buckland Avenue, pleaded no contest this week to 40 counts of forgery after prosecutors said she falsified checks at a local payday loan lending establishment.

The former manager at Ohio Payday Advance, Frasure, was accused of processing falsified cash loan applications and forging checks between December 2001 and March 2003. The totall amount she was accused of stealing? $30,000.

While avoiding jail time, Frasure will spend three years on probation. She'll also be required to pay restitution to the victims during her three-year probation period. The first payment is due next month.

Police said Frasure was in charge of processing short-term, high-interest payday loans for customers. After the customers had repaid their debt, Frasure used personal information from the company computer to create new payday loans in their name before forging the checks.

The scam was discovered when a customer tried to obtain a new payday advance, but was denied because records showed that person already owed money from a previous payday loan.