Norfolk, Va., Seeks to Regulate Payday Loans

By Paul RizzoPayday Loan Writer

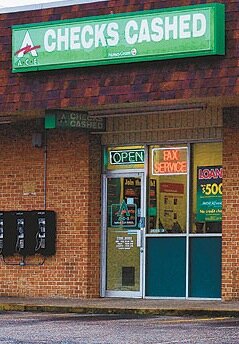

Payday loan companies spring up wherever consumer traffic is heavy, which means Norfolk, Va., in this case, reports the Virginian-Pilot.

“We’re located in malls and near big-box retailers because that’s where our customers are,” said Wayne Covert, a V.P. at Check into Cash, Inc., a Cleveland, Tenn., lender with 21 stores in Hampton Roads, Va.

The proliferation of payday lenders in and around Norfolk has been hard to miss. Since 2002, when the state opened its doors to providers of the short-term loans, the Virginia payday loan business has boomed, with stores opening in several shopping centers and along major corridors such as Virginia Beach Boulevard, Little Creek Road and Tidewater Drive.

The City of Norfolk, however, is seeking to curb payday loan growth by barring new stores from opening in large shopping centers, and by requiring an exemption for lenders seeking to open stores in other commercial areas. Existing payday cash advance locales would be allowed to continue doing business.

The proposed change in Norfolk’s zoning ordinance also would apply to check-cashing firms, auto-title lenders and retailers of used merchandise. The change would exclude antique stores from the restrictions. Used-car dealers and pawn shops would not be affected.

Payday loans are short-term, high-interest cash advances made to people who have a checking account and a steady source of income. When making a loan, lenders take a post dated check for the cash loan amount, plus the interest as collateral. If a borrower doesn’t return with a cash payment when the loan is due, the lender cashes the check.

In Virginia, licensed lenders are allowed to make loans of $100 to $500 for 1-4 weeks. They can charge as much as $15 for every $100, which works out to an APR of 390 percent for the typical two-week loan. Paul R. Riddick, a member of the City Council, expressed concern about the increasing number of payday advance locales in Norfolk.

“From my perspective, we have so many people looking for these to carry them through to the next paycheck,” said Riddick, whose district takes makes up the southeast area of Norfolk.

Many of the borrowers, Riddick noted, are lower-income individuals and members of the military. The proposal to restrict the opening of faxless payday loan stores, check-cashers, auto-title firms and used-merchandise retailers was approved by the city’s planning commission in March. The council has scheduled a public hearing on the measure for May 23.

Norfolk’s attempt to curb payday loans has been taking shape amid similar efforts by several other cities. In October, Jacksonville, Fla., imposed several restrictions on payday lending, including interest-rate caps on payday loans and a prohibition against lenders contacting the commanding officers of military borrowers who default on a loan.

Also this year, San Francisco imposed a moratorium on new payday advance loan and check-cashing stores while the city considers ways to limit the spread of these businesses in particular neighborhoods. Meanwhile, Phoenix and a handful of other cities have sought to restrain the Arizona payday loan industry's growth with similar measures.

Virginia’s Bureau of Financial Institutions reports the volume of payday loans in the state approached $1.2 billion last year, an increase of 21 percent from 2004. The number of payday advance loans, it said, rose 16 percent to 3.37 million. Meanwhile, the number of borrowers climbed 15 percent to 445,891.

Despite the best efforts of many anti-payday hawks, attempts in the General Assembly to abolish payday loans altogether in the state have stalled amid heavy lobbying by the industry and its opponents. Check into Cash played down the effects of high interest rates on frequent users of cash advance loans. Many of Check into Cash’s customers, the company says, use the loans due to a job loss, divorce or other unexpected problem.

“All we are doing is responding to demand,” a spokesman said. “We build where the customers are.”