Lisa Engelkins is a single mother raising a 5-year-old and making less than $8 an hour. She was struggling to keep up with her bills. After seeing an ad for no fax payday loans, she wrote a $300 check to the lender dated for cashing two weeks later and walked out with $255.

Bigger trouble began when she needed money to keep the check from bouncing. USA Today had the story.

Over the next two years, Engelkins repeatedly took out new $300 loans, paying $1,245 in fees for the privilege. The annual interest rate translated to 390% - loan shark levels, but legal in North Carolina in 2001.

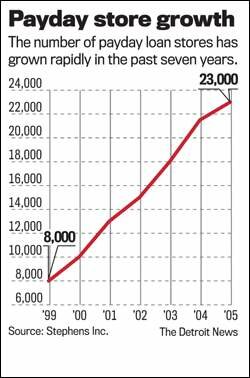

Today, the cash advance loan industry thrives in 37 states, often near military bases, courtesy of lawmakers who have neutered usury laws. Payday lending is an annual $40 billion business.

As shameful as that fact is, the response is mixed at best.

Payday loans act across the country: On Friday, with elections looming, Congress decided to act - tepidly. It slapped a 36% annual interest-rate cap on payday cash advances to service members and their spouses after a Pentagon report showed that the average military borrower was paying back $834 for a $339 loan.

Even that level is easily abused, and civilians got no protection.

Georgia tried another approach. In 2004, it banned small loans carrying annual interest rates exceeding 60%; violation could result in jail time. The industry fled the state, which is good for Georgians, but also a measure of how friendly the climate for unscrupulous lenders is elsewhere.

Providers of payday cash loans say they're just providing a costly service that short-term borrowers otherwise would lack. In fact, they have every incentive to act irresponsibly - and they do.

These companies extend credit whether borrowers can afford to repay the loans or not. They need only a bank account and a pay stub. There are no credit checks.

When a borrower can't repay, he becomes a cash cow for the lender, rolling over the loan or taking out a new one.

More than half the industry's revenues come from consumers who take out 13 or more payday loans no faxing a year, according to the Center for Responsible Lending, a consumer group that has worked to restrict payday lending.

North Carolina, where Engelkins got into debt, eventually found a sound way to rein in such problems. The state let its payday lending law expire. Instead, the State Employees Credit Union now offers short-term loans at a 12% annual interest rate. More than 40,000 people a month use the service, undercutting industry claims that it can't turn a profit under caps such as Congress' 36%.

One North Carolina official colorfully describes supposedly cheap payday loan lending as throwing an anvil to a consumer who needs a life preserver. Lisa Engelkins almost drowned that way. Lawmakers should throw people in her situation a lifeline.