Current Senator - Former Payday Loan Shop Owner - Rallies Against Cash Advance Industry

By J.J. CameronPayday Loan Writer

People are entitled to change their minds. Just ask Alabama Senator Lowell Barron.

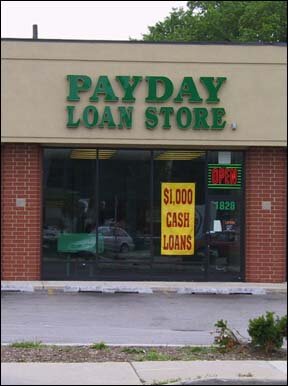

Not only has Barron gotten out of the industry in which he was once a major player - bad credit payday loans - but he's planning legislation against it now.

Barron outlined his reform plans this week in a meeting with editors/reporters of The Huntsville Times. He was accompanied by media and political consultant Steve Raby, who is working on Barron's re-election campaign.

The main focus of the senator's efforts? A ban on"rollover" payday cash loans that can quickly rack up hefty interest charges. His bill would also prohibit payday advance lenders from operating within five miles of a military base and outlaw the seizure of personal property on bad loans made by quick cash outlets.

Barron's opponent in the November election, Republican Don Stout of Fort Payne, suspects the reform push is driven more by Barron's re-election hopes than a desire to clean up an industry Barron profited from.

"That's like closing the barn door after the mule is out," Stout said Wednesday. "He's been in this business for years. I just wonder if he plans to give any of these people their money back."

Stout said recent political polls in their state Senate district, which encompasses DeKalb and Jackson counties and part of Madison County, have shown broad public disfavor with the faxless payday loan industry.

A payday advance past: A 2005 financial disclosure form filed by Barron with the Alabama Ethics Commission in April listed financial ties to numerous payday loan businesses.

But he and his family sold any interest in any stores months ago.

Officials with Alabama Arise, an advocacy group for the poor, said while they would prefer banning cash loan operations like Georgia has done, they welcome reforms that would protect consumers from getting gouged.

"The one thing that concerns us is the very fact that regulating the industry gives sanction to the practice and that, once in place, it makes it a whole lot harder to outlaw outright," said Jim Carnes, publications director for Arise.

Barron said his rollover protection provision would prohibit lending companies from extending payday or personal loans. It would also create a payday loan database to be maintained by the Alabama Banking Department in much the same way pharmacists keep tabs of prescriptions.

The payday advance plan: A central registry would help lenders comply with a provision barring loans to any customer who has received a payday loan in Alabama in the past 60 days.

"Payday loans were never intended to be primary loans. It should be emergency only," Barron said.

The payday loan industry has come under fire in recent years for lending practices critics say prey on Defenders call the loans a poor man's lifeline for many of life's surprises: an emergency medical expense, a car repair, a sudden jump in the cost of a prescription or utility bill.

Cash advance lenders sued the state in 1998 after the state Banking Department issued cease and desist orders to a handful of stores because they didn't follow a Small Loan Act limiting interest charges. The industry won an injunction, and a court-approved consent decree between the parties capped interest rates at 20 percent on a two-week advance.

Barron says his years in the faxless payday advance business convinced him of a need for stronger laws to protect consumers. Media attention on payday loan operators and a recent St. Clair County court ruling declaring excessive pawn shop interest rates unconstitutional also illustrates a need for reform, he said.

He likened payday loans to hiring a taxi.

"You pay a rate to go across town occasionally," he said, "but you wouldn't pay that taxi for a trip across the country."