Professor Shuns Idea of Military Payday Loans

By J.J. CameronPayday Loan Writer

Alan L. Feld is the Maurice Poch Research Professor at the Boston University School of Law. Let's just say he isn't a major supporter of military payday loans.

In a recent article in The Providence Journal, Feld discussed the major drawback of these cash advances: if a sailor is unable to pay off the loan could actually lose his security clearance, based on of financial mismanagement of personal debts. Without clearance, the sailor cannot be deployed overseas. It's not difficult to see how severe this can become.

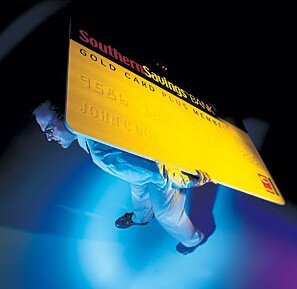

For many reasons, military personnel are high profile targets for providers of faxless payday loans such as these; they're often financially unsophisticated and far from family and friends. With full disclosure of the interest rates and compliance with Rhode Island's licensing requirements, a payday loan service can operate within the law here.

So, how can military payday loan problems be fixed? In one approach to the situation, Congress could prohibit high interest rates and set a limit on how much instant payday loan services may charge. A Senate amendment recently added to the Defense Authorization Bill of 2007 would cap the interest rate for loans to armed services members and their dependents at 36 percent; the interest-rate limit must still pass the House before going to President Bush for his signature.