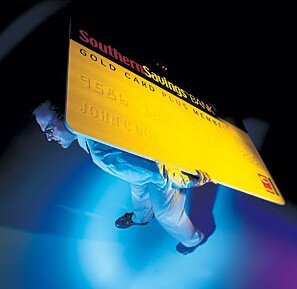

Consumer Debt Levels Rise in May; Credit Cards, Not Payday Loans, to Blame

By J.J. CameronPayday Loan Writer

As Americans took on large debt than expected in May - to the jaw-dropping total of $4.4 BILLION - it would be easy to blame the prolifieration of payday loans for these difficulties.

As Americans took on large debt than expected in May - to the jaw-dropping total of $4.4 BILLION - it would be easy to blame the prolifieration of payday loans for these difficulties.

However, revolving/mounting debt from credit cards was the main culprit.

Borrowers in the U.S. pushed up overall outstanding consumer credit by 2.4 percent (to a total of a cool $2.173 trillion) the Fed said Monday. As interest rates are raised by credit card companies, all of a sudden the use of pay day loans to help with this problem doesn't seem to expensive.

Nonrevolving debt, such as automobile loans, fell by 2 percent during the month. Meanwhile, a slowdown in consumer spending would allow the Fed to halt its interest-rate-tightening campaign. But if individals keep spending, the central bank would likely have to go further to tamp down inflation.

It seems unlikely Americans will stop charging items left and right. For that reason, you may wish to look into the world of payday loans online for assistance instead.