Critic of Payday Loans Named North Carolina Banking Commissioner

By J.J. CameronPayday Loan Writer

Mark Pearce, the president and chief operating officer of the Center for Responsible Lending in Durham - and a major cash loan critic - has been appointed a deputy state banking commissioner, Commissioner Joseph Smith Jr. said Wednesday.

The job will include oversight of the mortgage, consumer industries and legal divisions as well as working on financial services policy. It would be safe to assume that a major goal will be to continue work on alternatives to payday loans.

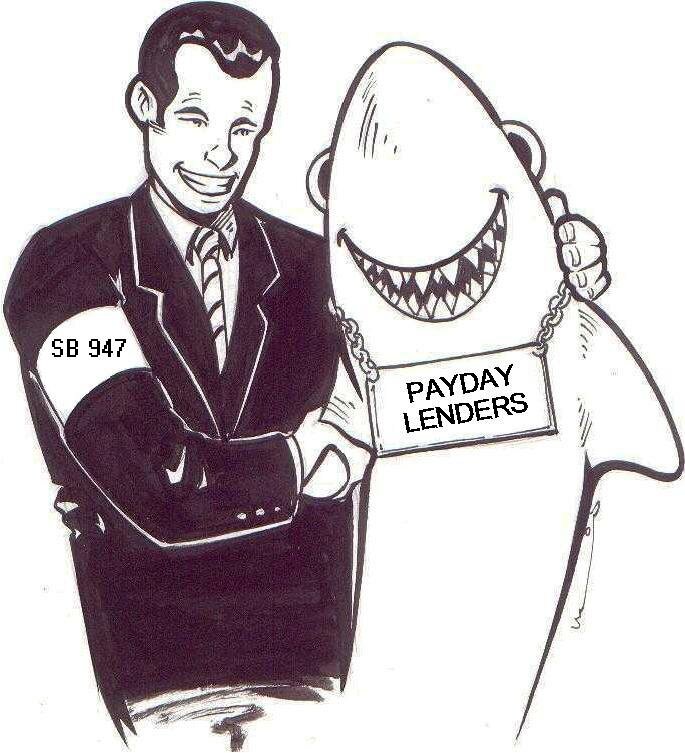

Pearce starts work in August. His hiring will probably increase pressure on the state to keep out payday cash advance lenders and push for affordable mortgage and consumer lending instruments for low-income residents. After all, the Center has been critical of payday loans lending, in which companies provide small, short-term loans with an effective annual interest rate of 400 percent or higher.

Smith’s office last year determined that Advance America, then the state’s largest payday lender, had violated consumer finance laws. From there, Attorney General Roy Cooper reached a deal with the last three major companies offering payday loans to leave the state.