Payday Loan Report Stirs National Debate

By Paul RizzoPayday Loan Writer

Payday loans are not necessarily predatory, says a surprising new report from the Federal Reserve Bank of New York.

Payday lenders are touting the report while consumer groups note that the report is still preliminary and does not reflect what they see in the real world of low-income borrowers.

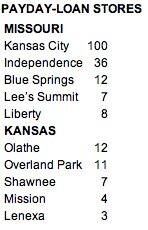

The report comes out at a time of growing concern about fast payday advance lenders. New Kansas Attorney General Paul Morrison has called for a round-table discussion on whether payday loans trap borrowers in long-term debt.

The report comes out at a time of growing concern about fast payday advance lenders. New Kansas Attorney General Paul Morrison has called for a round-table discussion on whether payday loans trap borrowers in long-term debt.

However, the report by Federal Reserve Bank of New York research officer Donald P. Morgan argues that contrary to arguments that payday loans are predatory, payday lenders may actually enhance the welfare of households by increasing the supply of available credit in a state.

The report agrees that bad credit cash loans can be expensive, but it found “credit delinquency rates are not higher for households in states with higher payday loan limits.”

Moreover, it said payday loans may provide a “preferable” alternative to pawn shops. “Despite their alleged naiveté, payday borrowers appear sophisticated enough to shop for lower prices.”

“This report gives clear and objective scholarly evidence that payday loans are not predatory,” said Darrin Andersen, president of QC Holdings in Overland Park and also president of the Community Financial Services Association of America, which represents many easy payday loan lenders nationally.

But consumer groups and credit counselors disagreed with the findings of the report, which they note is still preliminary. The report seeks comment from consumer groups and the public.

“It depends on how you define predatory,” said Tim Hagan, director of education for Consumer Credit Counseling Service in Kansas. “It appears the Federal Reserve report is an academic discussion,” he said. But, he said, in the real world, counselors are seeing more people trapped in payday loans with high fees.

The trap, he said, is that people don’t fully understand how payday cash advances, which can carry 390 percent annual interest rates, can be sucked into revolving debt with fees costing three times the amount of the debt.

“We’ve seen people in counseling who are just trying to maintain the fees on the debt.”

Both sides say the report will help spark more debate nationally.

That sounds terrible, until you realize lenders offer, at considerable risk of default, and with full terms’ disclosure, unsecured loans with fees of $15 or less per $100 borrowed. I may never take out such

That sounds terrible, until you realize lenders offer, at considerable risk of default, and with full terms’ disclosure, unsecured loans with fees of $15 or less per $100 borrowed. I may never take out such  These type of

These type of  The new proposal would create a system of “

The new proposal would create a system of “ Edwards and his colleagues appeared unmoved by the stirring testimony of trapped

Edwards and his colleagues appeared unmoved by the stirring testimony of trapped  “To the contrary, the report concludes that payday lenders may actually enhance the welfare of households by increasing the supply of credit.”

“To the contrary, the report concludes that payday lenders may actually enhance the welfare of households by increasing the supply of credit.”