Reactions to Military Payday Loan Cap

By J.J. CameronPayday Loan Writer

An agreement reached Friday by Congress to cap the interest rates that cash advance companies charge to military personnel or their spouses drew praise from those who work with cash-strapped soldiers at Camp Pendleton in California.

A General Accountability Office study released last month estimated that up to 19 percent of military personnel took out a quick cash loan last year. The loans averaged $350; were due in full typically on the next payday in 14 days; and carried annual interest rates and fees totaling 390 percent to 780 percent.

Michael Hire, who runs the Camp Pendleton office of the Navy-Marine Corps Relief Society, said such courses of action led to significant debt in the long run.

"We don't see that these payday advance businesses have helped service members out of financial difficulty," Hire said. "They have solved an immediate problem … but they are charging exorbitant rates."

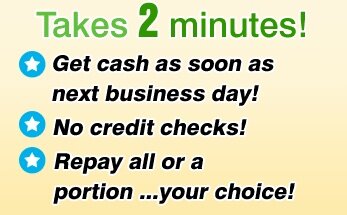

Hire, who teaches on-base financial seminars for troops, did acknowledge that some military members like the no-questions, no-hassles process offered by the payday advance companies.

Robert "Camo" Gleisberg, membership development officer for Pacific Marine Credit Union branch office at Camp Pendleton, agreed, saying many soldiers - especially those returning from deployment - have "very aggressive spending habits."

"They live beyond their means for a long period of time, then something blows up in their face or they make it worse by going to a predatory lending business," Gleisberg said.

The interest cap agreed to by House and Senate Republicans was to be approved as part of the 2007 defense authorization act.

The Community Financial Services Association of America, which represents more than half of the country's estimated 22,000 fast cash advance lenders, criticized the measure, saying military personnel only constitute 1.3 percent of the industry's revenue.

"While this will only have a slight impact on our industry's bottom line, it will have a large adverse impact on individuals in the military who need short-term credit," association president Darrin Andersen said in a written statement issued Friday.

Anderson argued that the limit eliminates option for soldiers in need of short-term credit. However, groups such as the Consumer Federation of American applauded Congress for agreeing to the legislation on cash advance loans.

"This historic legislation will protect members of the military and their families from financial predators who destroy their finances, damage their morale and undermine military readiness," Jean Ann Fox, the group's director of consumer protection, said in news release.