Payday Loan Company Shows its Charitable Side

By J.J. CameronPayday Loan Writer

For all the financial flak that faxless payday loan companies receive - being accused of taking advantage of the poor, for instance - it's nice to come across a story that shows a different side to these businesses.

Here's a perfect one.

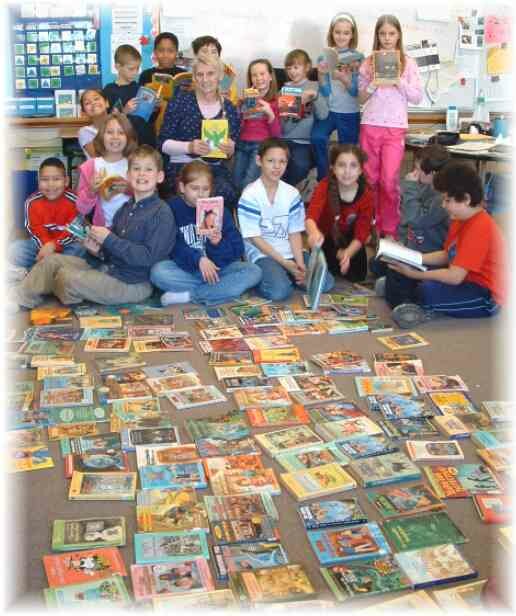

In a joint effort to help students recognize the importance of financial literacy, ACE Cash Express, Junior Achievement and the Texas Office of Consumer Credit Commissioner are distributing one million book covers to various schools across Texas.

"Our goal through this project is to make a difference in Texas schools by providing financial literacy lessons to help students learn how to successfully manage their money," said Jay Shipowitz, President and CEO of ACE Cash Express. "Focusing on financial literacy early in the educational process is a key step toward helping students to better manage their money."

Quite the opposing view from how many assume a provider of cheap payday loans would think.

The educational book covers include two financial literacy lessons, both designed to engage students on basic money handling and savings skills. By targeting elementary schools, the book covers help instill a sense of financial responsibility at an early age.

"Building sound financial skills should start early," said Leslie Pettijohn, Commissioner of Texas Office of Consumer Credit Commissioner. "Teaching kids to save is an invaluable lesson that can provide the foundation for lifelong positive money management."

The book covers are being donated to over 1,200 schools throughout Texas, and include both English and Spanish lessons. They were created as part of a recent collaboration of ACE Cash Express, Junior Achievement and the Office of Consumer Credit Commissioner to help bring more financial literacy programs into classroom.

Maybe someday these children will NOT need to apply over the Net for a payday loan online.

"Junior Achievement's core purpose is to inspire and prepare young people to succeed in a global economy," said Linda Schoelkopf, President, Junior Achievement of Dallas, Inc. "Working with ACE Cash Express and the Office of Consumer Credit Commissioner to provide financial lessons to younger students is a great addition to our regular volunteer-driven curriculum. We are proud to be a part of the effort to reach children throughout the state of Texas."