Payday Loan Company Expands Cash Advance Business to Mexico

By J.J. CameronPayday Loan Writer

For some companies, the payday loan business is alive and well. Take World Acceptance.

For 25 years, the firm has been giving small loans/payday advances to residents of Southern states who don't have access to credit. It's been a very successful formula: World Acceptance breezed through this decade's early economic slump with double-digit revenue and earnings growth.

"It's not that complicated," said Sandy McLean, the company's chief executive. "Our only earnings asset is our loan portfolio."

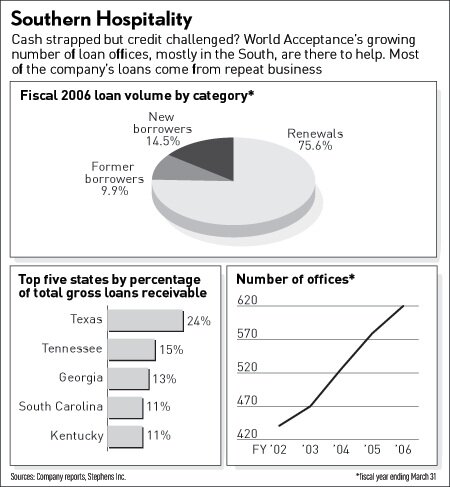

The payday loan company runs about 620 branch offices in 11 states. Its largest market, Texas, accounts for 20% of its loan portfolio. Now, though, it's looking to move even farther south … into Mexico.

Since September the firm has opened five offices in Juarez. World Acceptance plans to have 10 to 15 offices in Mexico by the end of March.

A personal loan success story: Revenue in the fiscal fourth quarter that ended March 31 was up nearly 22% from the earlier year to $73.4 million; earnings gained 32% to 96 cents a share.

McLean is not a new face at the quick payday loan company. He served as chief financial officer for 17 years. And he knows he doesn't need to change very much.

"We've had a very sound business plan since 1962 and we will continue to do the same things we've always done, hopefully into new markets," McLean said.

Mexico offers the kind of market World Acceptance caters to - lots of people with limited means and little or bad credit. The population's lack of credit access has been taken advantage of by U.S. pawnshop and payday loan chains - such as First Cash Financial - which started opening pawnshops in Mexico a few years ago. About 25% of First Cash's 2005 revenue came from that country.

Getting To Know You: The firm has a record of minimizing risk. Its collection loss rate runs under 4% of its total payday cash loan volume. That's far lower than the loss rate logged by most credit card firms.

"Sometimes these people in small towns are more creditworthy than you think," said Dennis Telzrow, analyst with Stephens Inc. "They may not have a bank checking account, but they still want to pay you back."

Because they don't often have other lending options, borrowers want to keep personal loan lines open for future needs, Telzrow says.

Because the loans are small, short term and high risk, World Acceptances charges high interest rates. Rates of 50% to 75% on an annual percentage basis are common, Telzrow says. Rates vary depending on state laws, however.