Arizona Payday Loan Lobbyists, Critics Spar Over Results of New Survey

By Desmond CarlislePayday Loan Writer

An industry survey says Arizona payday loan applicants tend to be “middle-income” and educated, as well as a bit younger than the statewide averagse.

But Arizona census figures suggest otherwise, according to the Arizona Daily Star. Census data shows payday loan applicants tend to fall into lower income brackets, prompting critics to question the survey’s legitimacy. The survey’s results were compiled using 600 payday loan borrowers in Arizona, all of whom where contacted by The Community Financial Services Association of America.

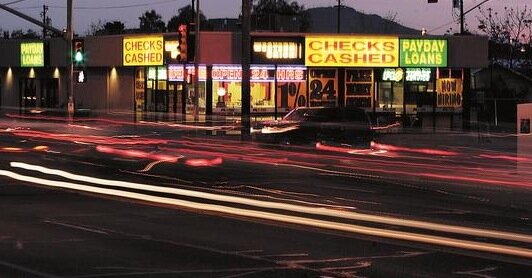

Since Arizona legalized payday loans in 2000, the industry has been criticized widely for taking advantage of the vulnerable. But very few attempts have been made to establish who actually uses payday loans.

According to the industry’s interpretation of the survey, half of payday advance customers are middle-income — defined as an annual household income of $25,000 to $50,000. However, five out of six people surveyed claim to make less than $50,000, suggesting that payday customers are more likely to be low-income.

According to U.S. Census data, half of Arizona households made more than $41,000 a year in 2003. A leading opponent of the payday loan industry dismissed the survey’s results, saying residents making $25,000 a year are not middle-income Arizonans, despite what the industry insists. The cash advance payday loan industry said the survey shows that customers in the Grand Canyon State are generally middle-income and educated.

But the Southwest Center for Economic Integrity, a Tucson-based consumer advocate which favors banning Arizona payday loans, said the survey does nothing to alleviate its concerns about predatory lending.

“What they desperately want is legitimacy, and that’s what these phone surveys are about. I don’t agree that a person making $25,000 a year is a middle-income consumer,” said deputy director Kelly Griffith.

Lee Miller, a payday loan industry lobbyist, disagrees. The industry points to the fact that the survey said 89 percent of customers were satisfied with their understanding of the terms and cost of their payday advance.

“I think that an important point that the survey makes is that payday (lending) is almost the antithesis of predatory lending,” he said.

A payday loan customer in Arizona can borrow up to $500 for two weeks at an interest rate of 15 percent over the next two weeks. Arizona demographics closely resemble those from other states, said Patricia Cirillo, president of the Cypress Research Group.

The Arizona survey did not ask about race, ethnicity or military service, nor did it ask how often customers used payday loans. Cirillo said some national payday chains have estimated their average customer is a repeat visitor, and uses eight loans a year.

For now, the future of Arizona payday loans is in the hands of the state legislature, which is debating several bills regarding payday loan laws.

March 21st, 2006 at 3:53 pm

[…] The training is intended to educate residents about their finances and the financial resources available in their neighborhoods. Recent surveys in the state have contrasted between just which income bracket payday loan applicants fall into. « Advance America Pulling Out of Arkansas […]