Payday Advance Industry Changes Questioned

By Paul RizzoPayday Loan Writer

Payday cash advance lenders have begun to hound Rena McFadden’s husband, threatening to take him to court unless he quickly repays the more than $2,000 he owes.

“The time to repay is too short. He’s been trying to talk to them, but they won’t talk,” McFadden, a 39-year-old who works in a dry cleaning shop, said recently. “They want the money by the next pay day. How are you supposed to pay your bills?”

Therefore, McFadden said she likes a proposal unveiled Wednesday by the payday lending industry allowing customers more time to pay back a loan. But she and consumer watchdogs still question whether people who use fast payday loans will really get help from an industry whose loans’ annual interest rates can exceed 400 percent.

“Payday lenders make it easy for consumers to get trapped in predatory debt,” said Teresa Arnold, legislative director for AARP in South Carolina.

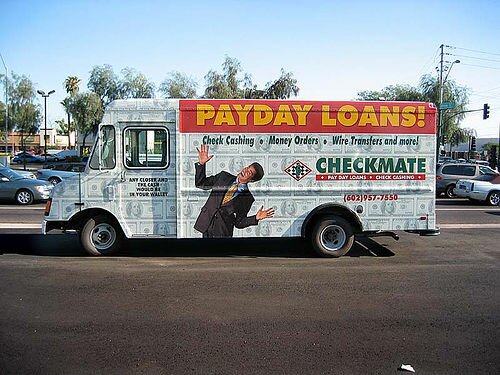

Payday lenders offer quick cash advances - for a fee - that customers are supposed to repay once they receive their next paycheck. Borrowers who cannot repay the guaranteed payday loan by the next payday often “roll over” the loan repeatedly, leading to more charges that can quickly add up and lead to a cycle of debt. Customers are drawn to the lenders because, unlike banks and credit unions, they don’t run credit checks.

The payday loan industry’s biggest change would give customers more time to pay back a loan with no financial penalty. This “extended payment plan” would be available at least once a year and provide borrowers between two and four extra months to pay off loans. It was paired with a $10 million ad campaign warning that payday loans are not a long-term financial solution and a ban on ads that promote payday advances for “frivolous purposes” like vacations.

The move came as states from Virginia to New Mexico consider legislation to limit payday lending practices. In South Carolina, home to the nation’s largest payday lender, lawmakers are considering a measure that would cap at 36 percent the annual interest fee on the loans, and limit the number of payday loans a consumer could have with a single payday loan company.

Opponents sniff that the lenders were outlawed because they trapped the neediest Georgians into an endless cycle of loans, and that relaxing the ban will roll out the welcome mat for crooked companies to return.

Opponents sniff that the lenders were outlawed because they trapped the neediest Georgians into an endless cycle of loans, and that relaxing the ban will roll out the welcome mat for crooked companies to return. That would leave room for only one more store in Sandy, which currently has 10 outlets after three moved in last year. Four more companies hope to open

That would leave room for only one more store in Sandy, which currently has 10 outlets after three moved in last year. Four more companies hope to open  “The governor is encouraged that this legislation reflects the recommendations of his advisory council on military affairs,” said Bill Maile, a spokesman for Schwarzenegger. “The administration is a sponsor of the bill and will work with the authors to ensure its swift swift passage.”

“The governor is encouraged that this legislation reflects the recommendations of his advisory council on military affairs,” said Bill Maile, a spokesman for Schwarzenegger. “The administration is a sponsor of the bill and will work with the authors to ensure its swift swift passage.” Democrats who control the state Senate promised today to put new limits

Democrats who control the state Senate promised today to put new limits  The Community Financial Services Association of America said it has launched a $10 million “national public education campaign aimed at informing consumers about the responsible use of

The Community Financial Services Association of America said it has launched a $10 million “national public education campaign aimed at informing consumers about the responsible use of  Governor Tim Kaine said today he would make “significant changes” to a package of

Governor Tim Kaine said today he would make “significant changes” to a package of  “People need a choice and a place to go in case something comes up and they need to make it from one payday to the next,” Greathouse said.

“People need a choice and a place to go in case something comes up and they need to make it from one payday to the next,” Greathouse said. “Helping to remove some of this type of predatory business … would certainly help to bring in more legitimate businesses.”

“Helping to remove some of this type of predatory business … would certainly help to bring in more legitimate businesses.”