Vote Delayed on Utah Payday Loan Stores

By Paul RizzoPayday Loan Writer

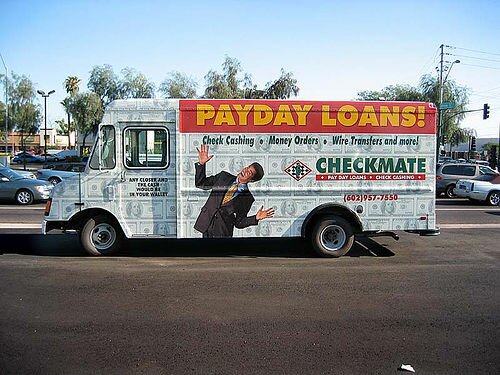

Only one more Utah payday loan store might be allowed in Sandy if the suburb decides to shut its door to such businesses.

The City Council has postponed for two weeks a vote on whether to limit non-depository financial institutions - those offering payday loans, check cashing, deferred-deposit advances or car-title loans - to one per 10,000 residents and to require at least a mile between such stores.

That would leave room for only one more store in Sandy, which currently has 10 outlets after three moved in last year. Four more companies hope to open instant cash loan stores in Sandy, but their applications are on hold until the council decides whether to limit the operations.

That would leave room for only one more store in Sandy, which currently has 10 outlets after three moved in last year. Four more companies hope to open instant cash loan stores in Sandy, but their applications are on hold until the council decides whether to limit the operations.

Councilman Scott Cowdell, who supports restrictions, asked city staffers to study whether such stores have a history of attracting crime.

But his council colleague Steve Fairbanks said the issue has been clouded by “emotional reactions” to the industry’s high interest rates, which typically start at 400 percent a year. He also disputed the notion of any correlation between bad credit payday loans and drug-related crimes.

Fairbanks would prefer to let the market decide how many stores locate in Sandy. Without competition, he argued, the outlets would have no incentive to consider lowering their rates.

“We’re hurting the people we think we’re saving,” Fairbanks said.

Salt Lake City and Salt Lake County also are considering density restrictions on payday cash advance lenders. South Salt Lake, West Valley City, Taylorsville, West Jordan, South Jordan, Draper and Midvale already have them.

At a public hearing this week, three people who work for Check City, including general counsel John Swallow, told council members the check cash advance industry provides an emergency cash source for low- and middle-income consumers when banks won’t help.

“The governor is encouraged that this legislation reflects the recommendations of his advisory council on military affairs,” said Bill Maile, a spokesman for Schwarzenegger. “The administration is a sponsor of the bill and will work with the authors to ensure its swift swift passage.”

“The governor is encouraged that this legislation reflects the recommendations of his advisory council on military affairs,” said Bill Maile, a spokesman for Schwarzenegger. “The administration is a sponsor of the bill and will work with the authors to ensure its swift swift passage.” Democrats who control the state Senate promised today to put new limits

Democrats who control the state Senate promised today to put new limits  The Community Financial Services Association of America said it has launched a $10 million “national public education campaign aimed at informing consumers about the responsible use of

The Community Financial Services Association of America said it has launched a $10 million “national public education campaign aimed at informing consumers about the responsible use of  Governor Tim Kaine said today he would make “significant changes” to a package of

Governor Tim Kaine said today he would make “significant changes” to a package of  “People need a choice and a place to go in case something comes up and they need to make it from one payday to the next,” Greathouse said.

“People need a choice and a place to go in case something comes up and they need to make it from one payday to the next,” Greathouse said. “Helping to remove some of this type of predatory business … would certainly help to bring in more legitimate businesses.”

“Helping to remove some of this type of predatory business … would certainly help to bring in more legitimate businesses.” The state Legislature last year finally approved a new state law cracking down on the exorbitant interest rates that the

The state Legislature last year finally approved a new state law cracking down on the exorbitant interest rates that the  Here are the facts: There is a need for short-term, unsecured credit. People living paycheck-to-paycheck have an occasional need for emergency cash. Options are limited. If you lack collateral, banks won’t give you a loan. Period.

Here are the facts: There is a need for short-term, unsecured credit. People living paycheck-to-paycheck have an occasional need for emergency cash. Options are limited. If you lack collateral, banks won’t give you a loan. Period.